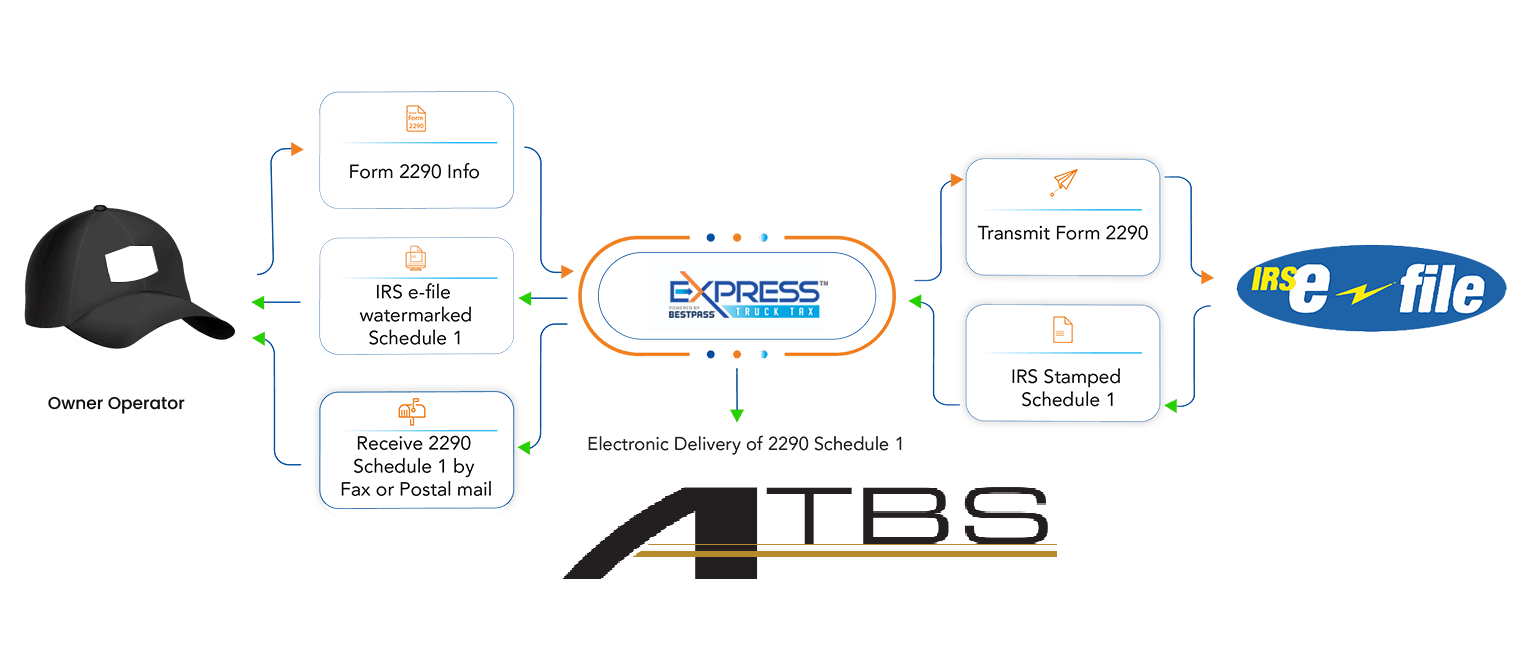

ATBS has partnered with ExpressTruckTax to offer truckers a simple way to e-file Form 2290 & 8849 with the IRS at the best value in the industry.

Why Choose ATBS for HVUT Filing?

File your Form 2290 Now in minutes with ATBS

Get 2290 Schedule 1 in 3 Simple Steps

CREATE ACCOUNT

- Register as a new user or login to your ExpressTruckTax account

- Gather your Business & Truck information

ENTER DATA

- Enter your business and truck information

- Choose from 3 IRS payment options

VALIDATE & E-FILE

- Let the program review and check your Form info for errors

- E-file Form 2290 to the IRS and get Schedule 1 in minutes

Get notified about your filing status Instantly

Keep your Business moving with these FREE Tools

HVUT Tax Calculator

Take the guesswork out of estimating your taxes with ExpressTruckTax’s Free HVUT Calculator. Quickly figure out your 2290 tax amount and know how much your HVUT will be.

IFTA Tax Calculator

Make your IFTA reporting hassle-free with our free IFTA calculator. Calculate your IFTA taxes online. Simple, easy, and accurate. Trusted by drivers like you.

What is IRS Form 8849?

The IRS Form 8849 Schedule 6 is used to file in order to claim your credit. If your vehicle was sold, stolen, destroyed, or for any vehicle on which the tax was paid on Form 2290 if the vehicle was used 5,000 miles or less on public highways (7,500 or less for agricultural vehicles) during the tax period.

What information is required to file 8849?

- You will need your name/address and make sure it is accurate to what the IRS has on file.

- You will also need your EIN number, and if you are not required to have an EIN, you can enter your social security number.

- To claim a refund, you will also need the date of the event that occurred to the vehicle sold/stolen/destroyed.

When can I e-file Form 8849?

If you have paid the Form 2290 Heavy Vehicle Use Tax and your vehicle was sold/stolen/destroyed, you can e-file Form 8849 at any time. You just have to pay Form 2290 HVUT first.

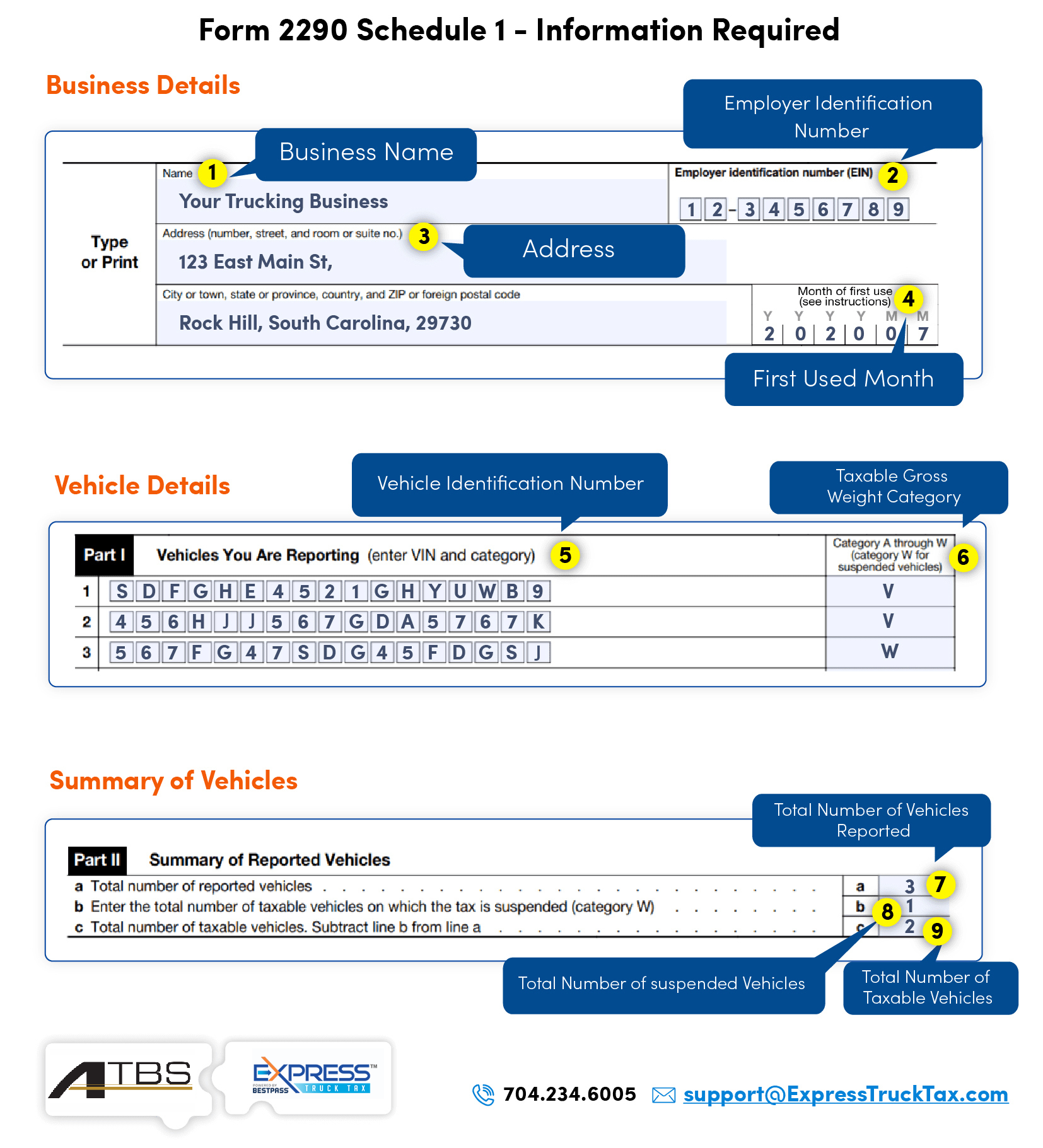

What is IRS Form 2290?

The IRS Form 2290 is used to file Heavy Vehicle Use Taxes, or HVUT as it is commonly known. Form 2290 must be filed on an annual basis for every heavy vehicle weighing at least 55,000 pounds. All you need is your basic business details, as well as your Vehicle Identification Number or VIN, and also the Gross Vehicle Weight. atbs.expresstrucktax.com can help you e-file Form 2290 with the IRS instantly.

Why E-file Form 2290?

Get Schedule 1 in minutes

No need to wait for a week when you can get your

2290 Stamped Schedule 1 within a few minutes! Simply Sign In to your account, E-file Form 2290 and get your Schedule 1 sent directly to the ATBS and also get instant access to your copy.

E-Filing Saves Time

Instead of waiting in a long queue at an IRS Office or heading to the Post Office, you can file Form 2290 conveniently from your home or even when you are on the go through mobile.

No Postage

Go paperless. No need for any paper and postal works. Switch to electronic Filing and save money and save the trees.

Real-Time Tracking

Keep track of the tax filing process & receive instant notifications via email, text, and fax when the return is officially accepted.

Save Your Vehicle Information

No need to re-enter the VIN numbers each time you file your IRS Form 2290. They will be readily available for you to process it for the next year.

Easy Record Keeping

If your records are ever requested by the IRS or the carrier, you can simply sign in to your account to access a copy of your Schedule 1.

Mandatory E-Filing

Owners of 25 or more vehicles with registered gross weights of 55,000 pounds or more are required to do mandatory e-filing.